Your Stock Options Aren’t Worth Anything

April 6, 2016

So you took a job at a start up and are excited by the Options the company gave you. The company tells you they’re worth $50,000 now, but in a just few short years you’ll have a million dollars in Options and be ready to drive that red Ferrari. Everyone’s going to make bank.

Too bad they neglected to mention a few things, in particular that these Stock Options are often referred to as golden handcuffs.

So… what are Stock Options?

Stock Options are just that, optional. You decide if you want to Exercise them or not. This is good and bad but at the end of the day it’s flexibility for you to decide what’s best. When you Exercise your Options, you’re paying the company money to convert your Options to actual Shares. They’re still not worth anything yet, but they could be. Someday.

How do you determine how much it costs to Exercise your Options? The company gave you a Strike Price that tells you what each individual Option is currently worth. For example, a company may grant you 100,000 Options at a value of $0.50 each. To Exercise the full 100,000 Options, you’d have to pay $50,000. The Strike Price is often set around once a year or when your company has a new valuation for each new set of Option grants, but never changes from your original grant.

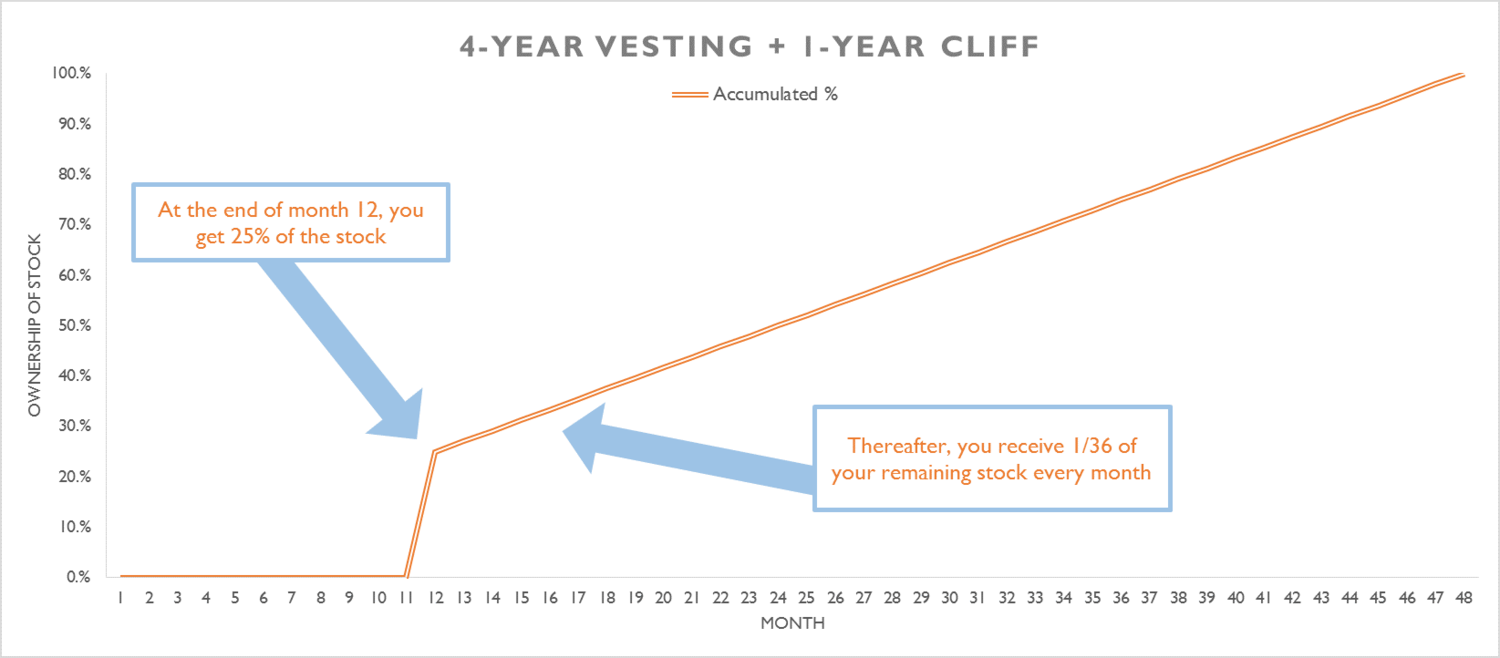

But there’s a catch: You can’t just Exercise your Options immediately. When you were hired, the company likely set these Options to Vest on a schedule. When Options Vest it means they’ve finally become available to you to purchase. The schedule at which Options Vest can vary, but often it’s something like “4 years, 1 year cliff”. This means that your stock Vests 100% over 4 years but doesn’t start until that one year “cliff”. So if you leave your company in 11 months, you’ll receive zero Options. It looks like the below graph, note the cliff starts at the 1 year mark.

Once your Options have Vested and you’ve Exercised your options at their set Strike Price, you now have Shares. But you’re not rich yet.

Getting rich with Stock Options

Hopefully that wasn’t all terribly excruciating to learn about. To put that knowledge to work, here’s some scenarios that can play out with your Stock Options.

Scenario A

Let’s say Abigail was hired and the company granted her 100,000 Options with a Strike Price of $0.50. Abigail works diligently for the company for 11 months but finds out her mother is ill and she has to move back home away from the company and so she must leave the company. Even though Abigail was a hard worker, she didn’t fulfill her 1 year Cliff requirement and zero of her Options became available to her. Sorry, Abigail.

Scenario B

Bob gets hired at a different company and gets the same deal — 100,000 Options at a Strike Price of $0.50. He works for his company for 12 months but the company isn’t treating him right and he’s had enough of their shenanigans. He decides to leave the company. Because he made it the full 12 months of his 1 Year Cliff, his Options Vested and he gained 25% of them (25,000).

But there’s a catch!

The company’s agreement with its employees tell them that as soon as they leave, they have 3 months to Exercise their Vested Options otherwise they forfeit them back to the company.

Some companies like Clef are working to extend the period that allows you to Exercise your options, but Bob’s company wasn’t Clef. Bob forgets about this requirement and he loses all of his Options.

Scenario C

Claire gets hired at a company and predictably receives 100,000 Options at a Strike Price of $0.50. She waits 12 months for her 1 Year Cliff and now has 25,000 Vested Options. She’s extremely confident the company will be successful and wants to Exercise her Options immediately. After all, the company’s most recent valuation says it’s now worth $10 per share! She pays the company $12,500 ($0.50 x 25,000) and receives her Shares paperwork. She just made a pretty penny with her Shares now being valued at $250,000.

Claire didn’t realize the IRS has a tax called the Alternative Minimum Tax. The AMT says that when you Exercise your Options, you realized a profit between your Strike Price and the current valuation. For Claire, the IRS says she now owes tax on her “profit”, $237,500.

Unfortunately for Claire, her instincts about the company were wrong and the stock crashes. The IRS doesn’t care and Claire still owes the IRS approximately $70,000. At least she convinced them to set up a payment plan.

Scenario D

Stop me if you’ve heard this before. Danny gets hired at a company and receives 100,000 Options at a Strike Price of $0.50. He loves the company and has been around for 4 years, enough to have Vested all of his Options. He’s heard that the most recent company valuation is $15 per share. This means his current Options are valued at $1,500,000. He’s rich! If the company goes public at $30 per Share, he’ll be a multimillionaire!

Danny knows the IRS has an AMT which means he’d have to pay $450,000 to Exercise his 100,000 Options. He can’t afford that. So he waits. Danny was also a very early employee and he knows the average company VC-backed company IPOs after at least 8 years. So he waits longer.

About 5 years into the company’s life, there’s a scandal in the company that drives out Danny’s manager and the new manager is a real jerk, forcing Danny into bad situations and requiring overtime every week. Company culture is deteriorating and Danny hates everything about it. But he remembers if he just waits, he’ll be rich.

So Danny waits. Stressing about his job, performing poorly, feeling those golden handcuffs.

Danny’s poor performance catches up to him around the 6.5 year mark and Danny’s fired.

Danny can’t afford his AMT and isn’t able to secure a loan to pay it. He didn’t work there 6.5 years to see those Options go to waste. Danny gambles and Exercises his options anyway. The IRS sets up a payment plan with him and Danny waits to see if his Stock will be worth anything.

Your Stock Options won’t make you rich

While it’s fun to dream about Stock Options, there’s unfortunately very few scenarios that work out in your favor. The above scenarios are just a few of how things could go badly. There’s additional complexities like warrants and common/preferred stock levels and more acronyms like ISO, NSO and RSU.

Things can go wrong at any point and it’s good to take the value of your Options with a large grain of salt. Enjoy them, just plan for the worse.

Bonus: Learn More

There’s a lot written on this subject but it’s often hard to find the answers to your questions (or even know what questions to ask). There’s also some companies out there working to increase your options when it comes to your Options. Here’s some links that might help:

Clef Equity Handbook (Interesting: Extends the 90 day Exercise window to 7 years.)

The Open Guide to Equity Compensation

When to Exercise Stock Options (Hint: Either very early on or at IPO filing.)

I am by no means an expert on the subject, but I enjoy learning and talking about it. Have a question or comment? Let me know!